Hacks and exploits remain possible in 2023

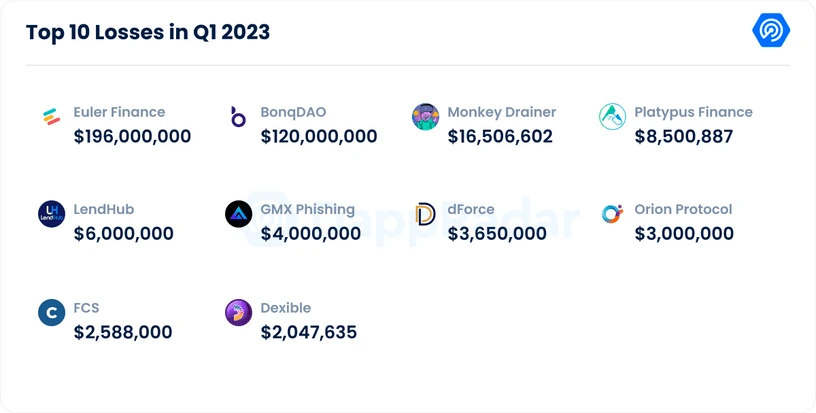

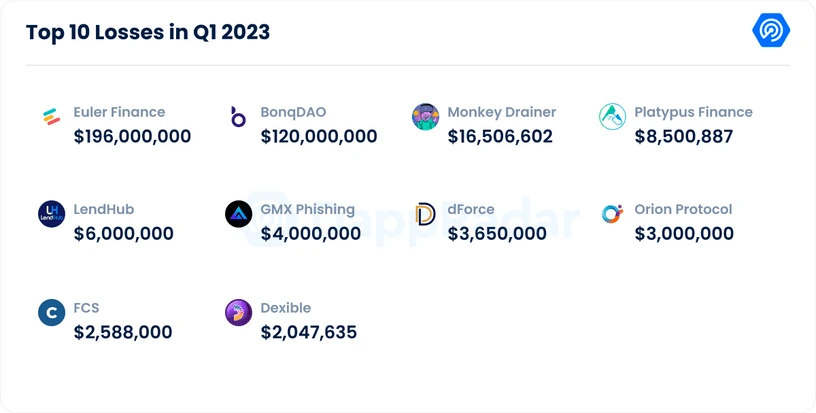

The crypto community has seen over 370M USD worth of crypto stolen due to hacks and exploits during the first three months of 2023. In comparison to the last quarter of 2022, when 5B USD in total was lost because of cyberattacks, the reported amount for 2023 seems very low.

In October 2022, more than 1B USD’s worth of crypto was stolen, while in November, that number grew to over 3.9B USD, before dropping to 87M USD up to the end of the year.

According to Rekt, a journalism website dedicated to crypto, 215M USD – or 57% - out of the total $370M USD - was stolen during the first three weeks of March. “It’s worth noting that January 2023 was one of the lowest months for hacks, with a total of 14.6 million USD lost, a sum that wasn’t registered in all of 2022. This may be a positive sign that the industry is taking security more seriously and implementing better measures to prevent hacks and exploits,” said DappRadar on its website.

In March 2023, the most notable hack of the first quarter was the flash loan attack on Euler Finance, which saw millions of dollars’ worth of crypto stolen. The hacker stole 196M USD in various cryptocurrencies, including DAI, USDC, WBTC, and stETH using a multi-chain bridge that allowed them to transfer digital assets between blockchains.

Flash loan attacks are made possible with smart contracts enabling participants to borrow funds without the need for collateral. The graph below from Chainalysis Reactor shows how the hacker moved the funds during the attack:

.webp)

At the end of March, the exploiter had already returned most of the stolen funds to Euler Finance, totaling 51,000 ETH or 177M USD. It is understood that the attacker sent encrypted messages to Euler to apologize for their actions.

The second largest exploit that happened during the first quarter of 2023 was the attack on BonqDAO in February, when 125M USD was exploited. The hacker was able to manipulate the BonqDAO price oracle to increase the WALBT price, which led them to mint over 100M BEUR. They then manipulated the price once again and liquidated the digital assets. This operation resulted in 10M USD’s worth of crypto, specifically 113.8M WALBT and 98M BEUR, being taken.

The interesting point to make about all these exploits in 2023, is that BNB Chain accounts for more than 50% of them. According to Rekt, 18 hacks were identified to have happened on BNB Chain, while only 10 incidents occurred on Ethereum.

Even though cyberattacks have been down since the last quarter of 2022, it is worth mentioning the need for increased security measures on several chains, like BNB Chain, Ethereum and Polygon. On that same note, users should be cautious when transacting, as hackers could be lurking anywhere.

Sources: thedefiant.io, dappradar.com, blog.chainalysis.com

analyst opinion

Diego Kebork

The crypto community has seen over 370M USD worth of crypto stolen due to hacks and exploits during the first three months of 2023. In comparison to the last quarter of 2022, when 5B USD in total was lost because of cyberattacks, the reported amount for 2023 seems very low.

In October 2022, more than 1B USD’s worth of crypto was stolen, while in November, that number grew to over 3.9B USD, before dropping to 87M USD up to the end of the year.

According to Rekt, a journalism website dedicated to crypto, 215M USD – or 57% - out of the total $370M USD - was stolen during the first three weeks of March. “It’s worth noting that January 2023 was one of the lowest months for hacks, with a total of 14.6 million USD lost, a sum that wasn’t registered in all of 2022. This may be a positive sign that the industry is taking security more seriously and implementing better measures to prevent hacks and exploits,” said DappRadar on its website.

In March 2023, the most notable hack of the first quarter was the flash loan attack on Euler Finance, which saw millions of dollars’ worth of crypto stolen. The hacker stole 196M USD in various cryptocurrencies, including DAI, USDC, WBTC, and stETH using a multi-chain bridge that allowed them to transfer digital assets between blockchains.

Flash loan attacks are made possible with smart contracts enabling participants to borrow funds without the need for collateral. The graph below from Chainalysis Reactor shows how the hacker moved the funds during the attack:

.webp)

At the end of March, the exploiter had already returned most of the stolen funds to Euler Finance, totaling 51,000 ETH or 177M USD. It is understood that the attacker sent encrypted messages to Euler to apologize for their actions.

The second largest exploit that happened during the first quarter of 2023 was the attack on BonqDAO in February, when 125M USD was exploited. The hacker was able to manipulate the BonqDAO price oracle to increase the WALBT price, which led them to mint over 100M BEUR. They then manipulated the price once again and liquidated the digital assets. This operation resulted in 10M USD’s worth of crypto, specifically 113.8M WALBT and 98M BEUR, being taken.

The interesting point to make about all these exploits in 2023, is that BNB Chain accounts for more than 50% of them. According to Rekt, 18 hacks were identified to have happened on BNB Chain, while only 10 incidents occurred on Ethereum.

Even though cyberattacks have been down since the last quarter of 2022, it is worth mentioning the need for increased security measures on several chains, like BNB Chain, Ethereum and Polygon. On that same note, users should be cautious when transacting, as hackers could be lurking anywhere.

Sources: thedefiant.io, dappradar.com, blog.chainalysis.com

Previous

Next